Configure Index Funds

Configuring index funds is a multi-step process. A complete explanation of the steps involved in the process are provided below in the order in which they should be performed.

Step 1: Create the Plan

The first step is to create the plan that will use index funds.

-

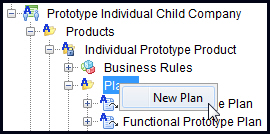

In the Main Explorer of the Rules Palette, navigate to Companies | Name of Company | Subsidiary Companies | Name of Subsidiary Company | Products | Name of Product | Plans.

- Right-click on the Plans folder and select New Plan. Skip this step if the plan already exists.

Plan Menu in Main Explorer

-

In the New Plan wizard enter the following:

-

New Plan Name: The name of the product being configured.

- Currency Code: Select the default currency for the plan.

- Market Maker: If converting currencies for funds, select the market maker.

- Plan Effective Date: Enter the date when the plan will be available for enrollment.

- Plan Expiration: Enter for plans that are only available until a specific date.

- Point In Time Valuation: Select No. This is not available for index funds.

- Plan Allocation Method: Use Default or Plan Allocation Method. Both methods use parent level funds.

-

Step 2: Configure the Fund Screen

Configure fund fields that will allow funds to be properly identified. For example, this is where fields are created for the Fund Index, such as S&P 500 or NASDAQ. Other fields could be the Index Calculation Method to use such as Cap, Spread, Floor and Participation.

Refer to the Create Parent Level Funds section for the necessary steps to configure the FundScreen rule. Only configure the <ParentField> element when creating fund fields. Index funds must use parent funds.

Step 3: Create Interim Fund

Because of the design of Index products, funds must be created to hold premium until the Sweep date is reached. These interim funds are fixed assets and use the InterestRateCalculation business rule to value the interest rate that will be credited.

Refer to the Create Parent Level Funds section for the necessary steps to configure funds.

Step 4: Create Index Funds

Create the index funds and select the fund fields configured in Step 2 from the section above. These funds are variable based and use daily values of the index for calculating the Index Credit. When selecting the index design characteristics, such as fund index, index calculation method, etc., the actual logic is not yet added. This just identifies that the elements are used. Configuration occurs later in the transactions, copybooks and other rules. Index funds will eventually be mapped to the plan.

Refer to the Create Parent Level Funds section for the necessary steps to configure funds.

Step 5: Configure Allocations

After the funds are set up, the allocation structure that allows OIPA end users to select the actual funds they want to allocate their premiums to must be configured. Use either the Default method or the Allocation Model method.

Refer to the Default method or Allocation Model section for additional information.

Step 6: Configure the InterestRateCalculation Rule

The InterestRateCalculation business rule is the rule that should be configured for fixed funds. Configure static interest rates that are commonly used for interim funds. There are various interest rate calculation elements that can be configured to customize how the interest is calculated. This rule is overridden and attached at the fund level.

Refer to the InterestRateCalculation section for additional information.

Step 7: Create Rate Groups and Enter Initial Rates For Indexed Funds

Index funds need separate rate tables to store index values. After the tables are created, RATE and RATEARRAY math variables can be used to pull data into configuration logic for index calculation methods.

Refer to the Rate Overview section for additional information on creating rate groups and entering rates.

Step 8: Create Rate Groups and Enter Initial Rates For Growth Cap, Growth Floor, Participation Rate and Spread

Index fund product design uses various percentages that can change. Rate groups can be created to support this. These rate groups can hold values for design elements such as Growth Cap, Growth Floor, Participation Rate and Spread. After the initial rates are loaded into the rate structure, you may decide how additional values are loaded in the future, whether it be manually though the Rules Palette or through AsFile.

Refer to the Rate Overview section for additional information on creating rate groups and entering rates.

Step 9: Set Up Static Values

A typical product design will require static values to be set that are called by configuration. The Product Data node can be configured for values such as Maximum buckets and Sweep Dates. These fields should be configured in the PlanScreen rule. The values can be entered in the Plan Data node.

- Navigate to the PlanScreen rule in the appropriate plan and check out the rule.

- Configure the fields that will store the static values required then check in the rule.

- Navigate to the Plan node and check out Plan Data.

- Enter the values in the fields that were configured in the PlanScreen rule.

- Check-in the Plan Data.

Step 10: Configure Reusable Configuration

Index funds products will reuse logic to calculate items such as the index credit or the actual sweep date. CopyBooks or Function rules can be used to configure this reusable logic. Transactions and other rules will call CopyBooks and Functions for these commonly used configurations.

The image below is taken from the Index Prototype Plan that is provided with the release. The prototype uses CopyBooks to calculate the credit for the index. Math variables are set up for the methods of crediting. Then a SQL is used to retrieve the actual index method set for the fund, which was set when the fund was created (from step 4). Other values are then queried to retrieve values from the rate tables that were created. The IF statements are used to figure out the index method and then run custom calculations.

Refer to the CopyBook prototoype examples for specific CopyBook configuration. Navigate to Main Explorer | Companies | Prototype | Subsidiary Companies | Prototype Individual Child Company | Products| Individual Prototype Product | Plans | Index Prototype Plan | Business Rules | CopyBooks.

CopyBook Used for Index Funds

Step 11: Configure Transactions

Transactions must be configured to move the policy through its lifecycle. Some examples of events that are controlled by transactions are issuing the policy, applying money in and transferring money from the interim account into index funds on the Sweep Date.

For a complete example of the basic transactions required, review the transactions in the Index Prototype Plan, which demonstrate transactions that support the design of an Index product. A base segment is also needed to support the full product lifecycle. Navigate to Main Explorer | Companies | Prototype Company | Subsidiary Companies | Prototype Child Company | Plans | Index Prototype Plan | Transactions | Policy Transactions.

When working with the Withdrawal transaction, notice that as money is moved out according to a removal precedence and removal method that was established during fund creation. PureLIFO and ProRataLIFO are the methods that must be used with index funds.

- PureLIFO: last in/first out removal method for index funds. Applies across all indexed funds with the same removal precedence removing from the newest bucket first.

- ProRataLIFP: last in/first out removal method for index funds. Pro-rate across indexed funds first and then removes from the newest bucket first in each fund.

Bucket removal is based on the BucketEffectiveDate attribute of Assignment. This information is held in the AsBucket table.

Transactions in Index Prototype Plan in Rules Palette

Step 12: Configure the ValueScreen Business Rule

The ValueScreen business rule must be configured for index funds. Refer to the Value Screen section for configuration information.

Related Topics

Configure Funds, Fund Database Tables, Child Funds, Currency Codes for Funds, Fund Screens in OIPA, Allocation Models